Navigate the path to financial success.

Use the Your Lifestyle Bank GPS app to manage your finances, keep a pulse on your network, and simulate advanced financial strategies to see how they can help grow your assets.

Use the Your Lifestyle Bank GPS app to manage your finances, keep a pulse on your network, and simulate advanced financial strategies to see how they can help grow your assets.

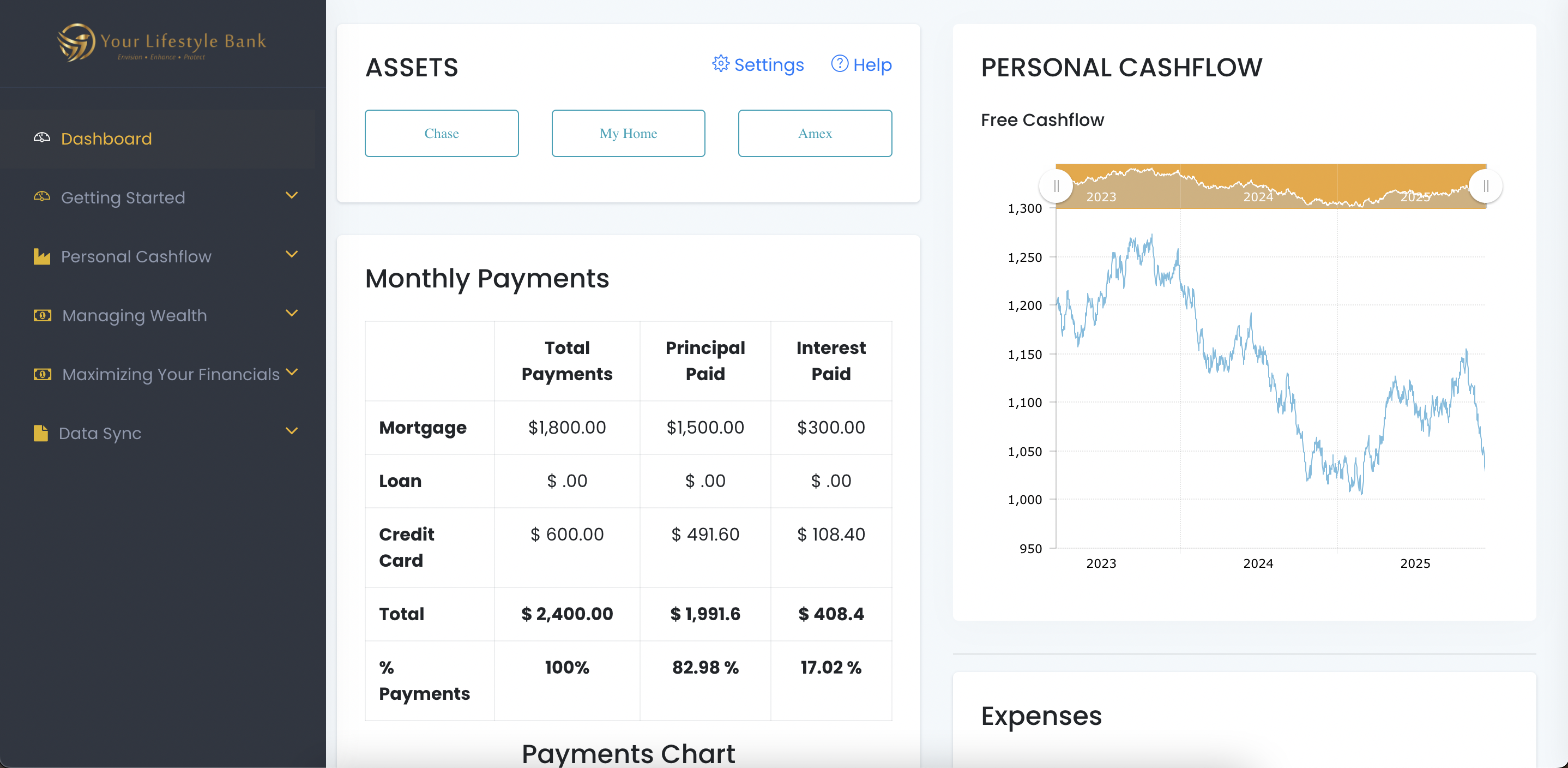

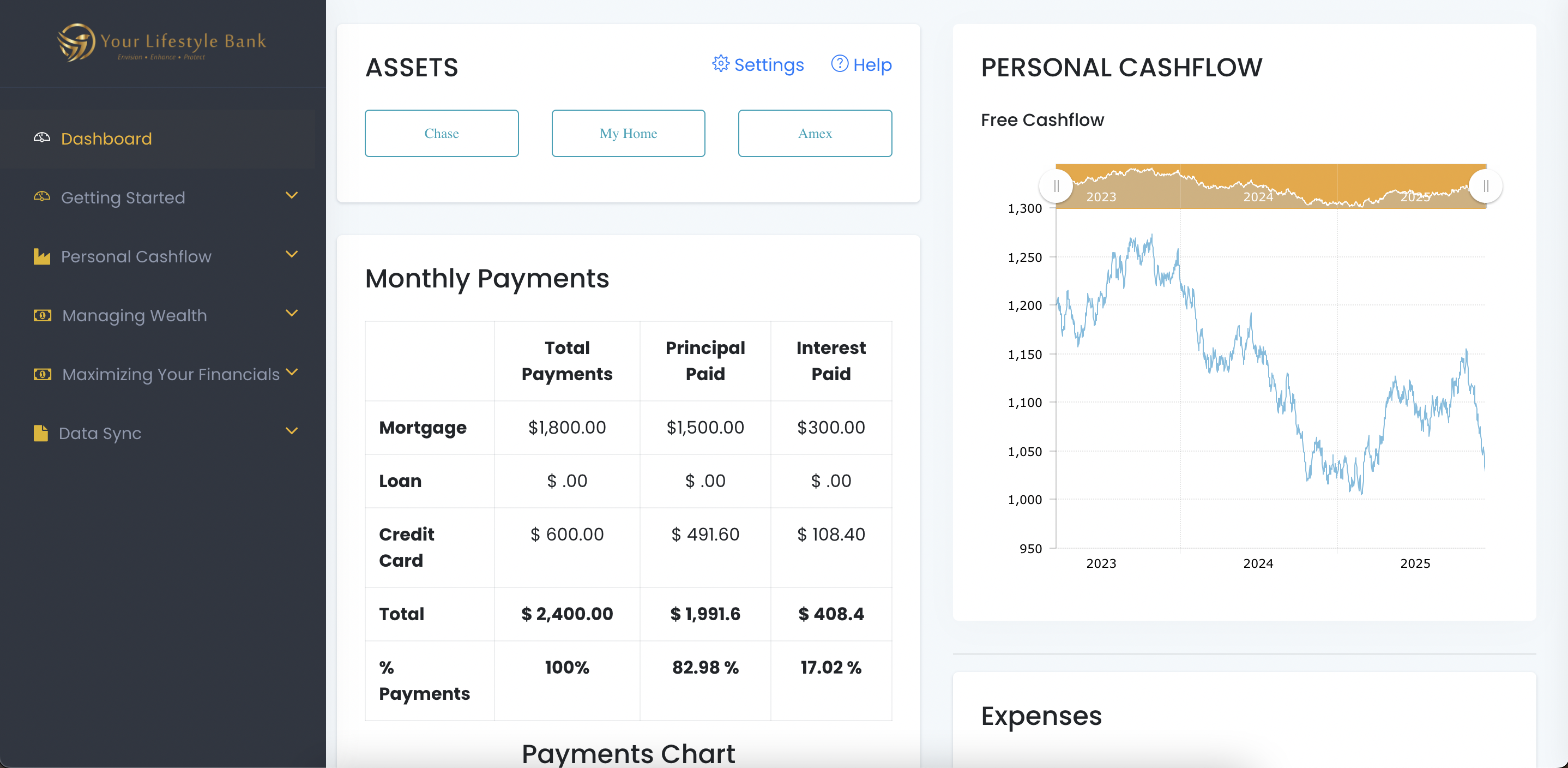

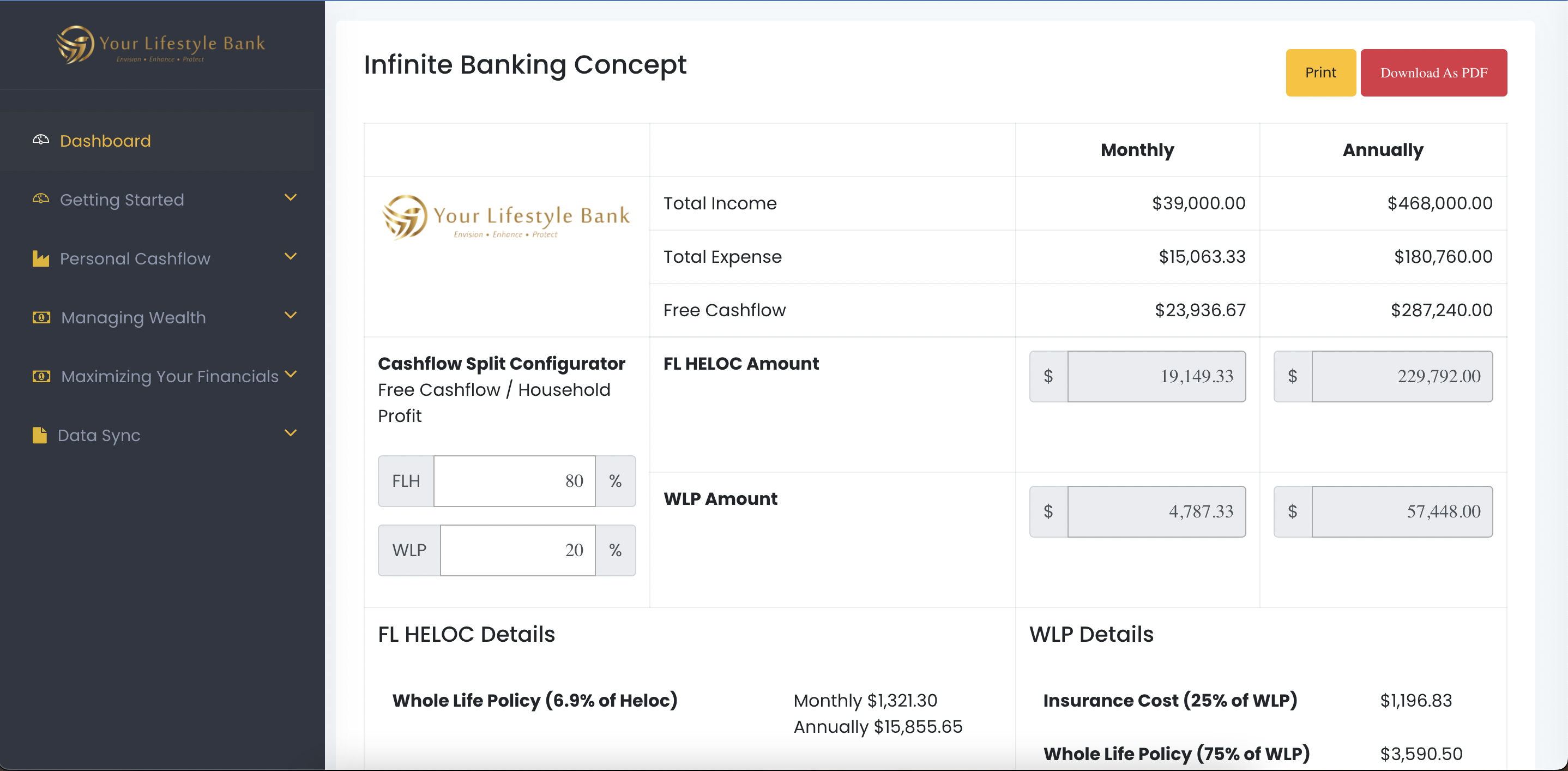

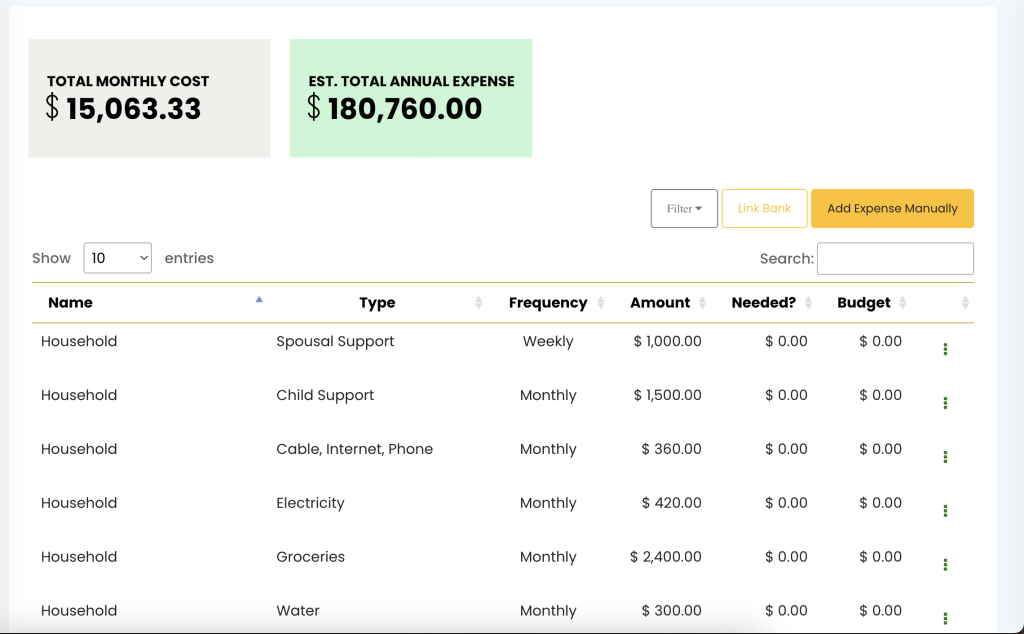

Use our financial software to track your day to day finances. Manage debt paydown timelines to see interest vs. equity paid. Track the value of each asset and calculate your networth easily.

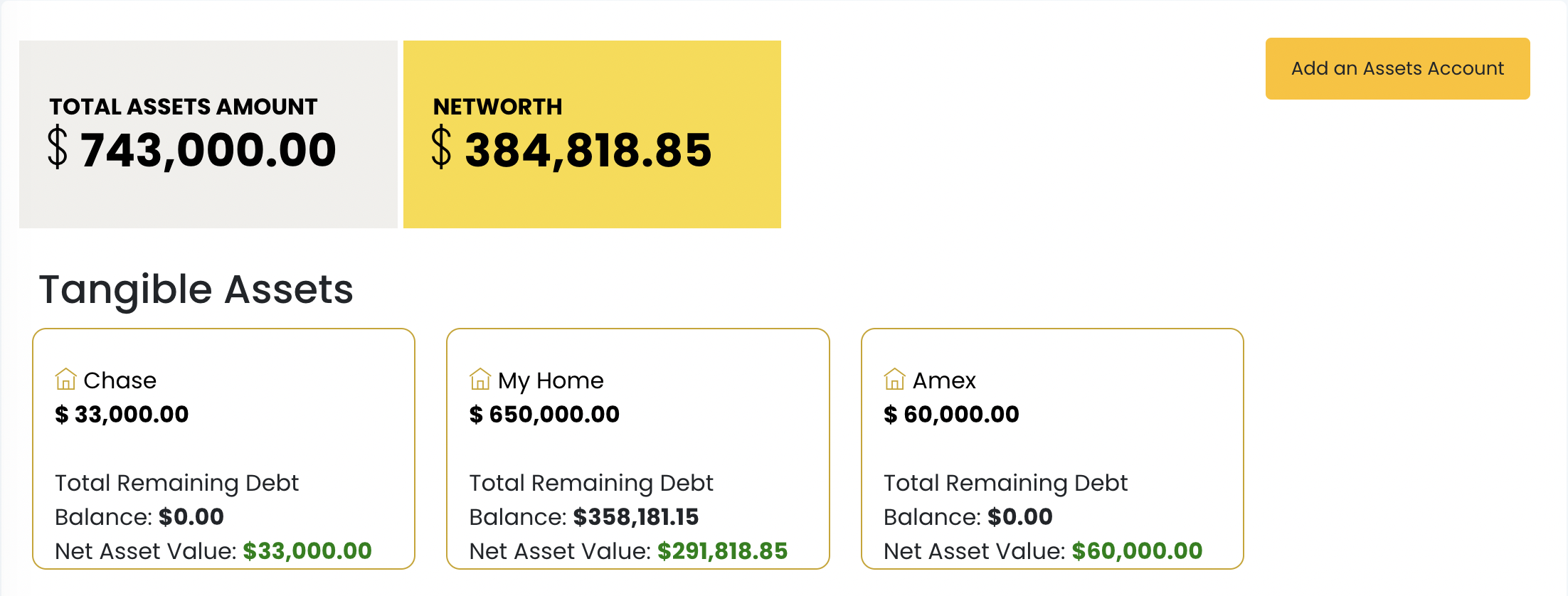

Explore new financial strategies like Infinite Banking or Velocity Banking and simulate what your networth could look like over time across a variety of financial simulations.

Integrate accounts automatically to manage your budget, track your spending, and hold accountable to the growth of your networth.

Unlike traditional banks and financial institutions, Your Lifestyle Bank is focused on providing personalized financial solutions that are tailored to each client’s unique needs and goals. Our team of experts works closely with clients to develop a comprehensive financial strategy that is designed to help them achieve their financial objectives.

By using Your Lifestyle Bank, you can increase your wealth securely and predictably, obtain short-term and long-term financial goals in the least time possible, and even access your cash value in the policy through policy loans.

Yes, you need to pay interest on your policy loan, but typically at below-market competitive rates. If you don’t pay the interest, the company will automatically add it to your loan balance. However, it’s a good idea to pay the annual interest due on your policy to prevent your loan balance from increasing.

You don’t have to repay your policy loans, but it’s recommended to do so. If you don’t pay back the loans, the interest will continue to accrue, and the outstanding loan balance will be deducted from your death benefit.

Policy loans allow you to borrow against your policy’s cash value and use the death benefit of your policy as collateral. You can borrow up to 85-90% of your cash value and use the money for emergencies, important purchases, education, business expenses, or retirement funding.

Yes, Your Lifestyle Bank is FDIC insured up to $250,000 per depositor, per insured bank, for each ownership category.

Meet with one of our associates to explore the benefits of using the YLB GPS app to grow your networth.

With Your Lifestyle Bank, you can have confidence in your financial future.